Find present value of annuity

Use the PV of 1 Table to find the rounded present value figure at the intersection of n 12 3 years x 4 quarters and i 2 8 per year 4 quarters. Present Value Growing Annuity PVGA Payment Calculator.

Annuity Present Value Pv Formula And Calculator Excel Template

This means that the present value of the cash flows decreases.

. A present value calculation is also an effective way to compare different pension choices. The present value of an annuity is the current value of a set of cash flows in the future given a specified rate of return or discount rate. Once the value per dollar of cash flows is found the actual periodic cash flows can be multiplied by the per.

A table is used to find the present value per dollar of cash flows based on the number of periods and rate per period. The present value of receiving 5000 at the end of three years when the interest rate is compounded quarterly requires that n and i be stated in quarters. Present Value Annuity Formulas.

Net Present Value is a frequently used financial calculation used in the business world to define the current value of cash inflows produced by a project asset product or other investment activities after subtracting the associated costs. For example youll find that the higher the interest rate the lower the present value because the greater the discounting. The formula to calculate the future value of the investment is.

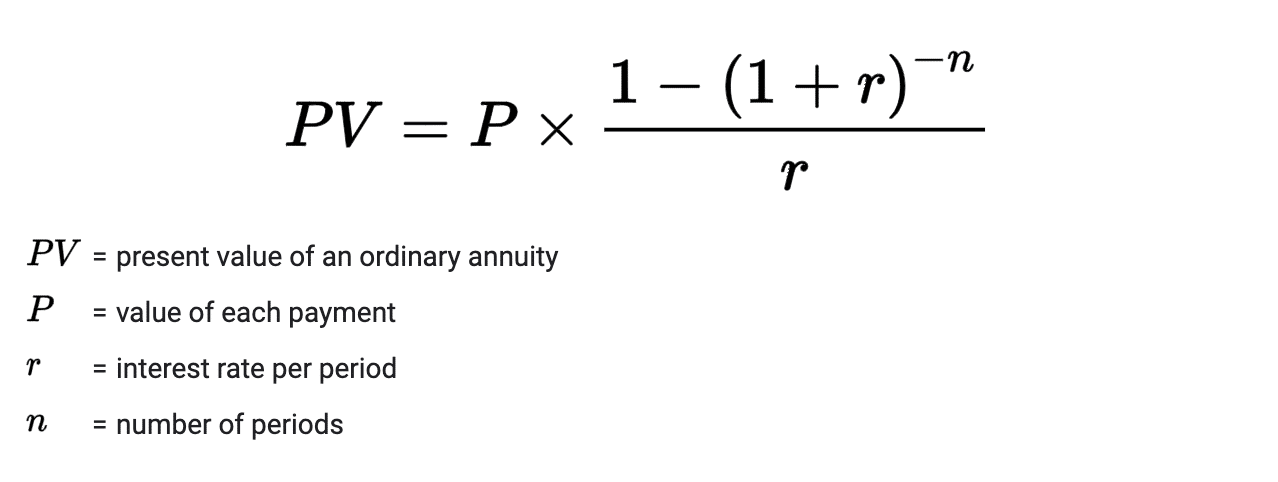

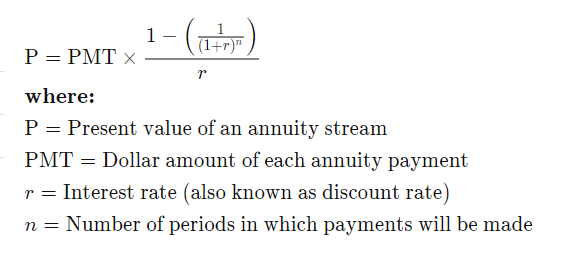

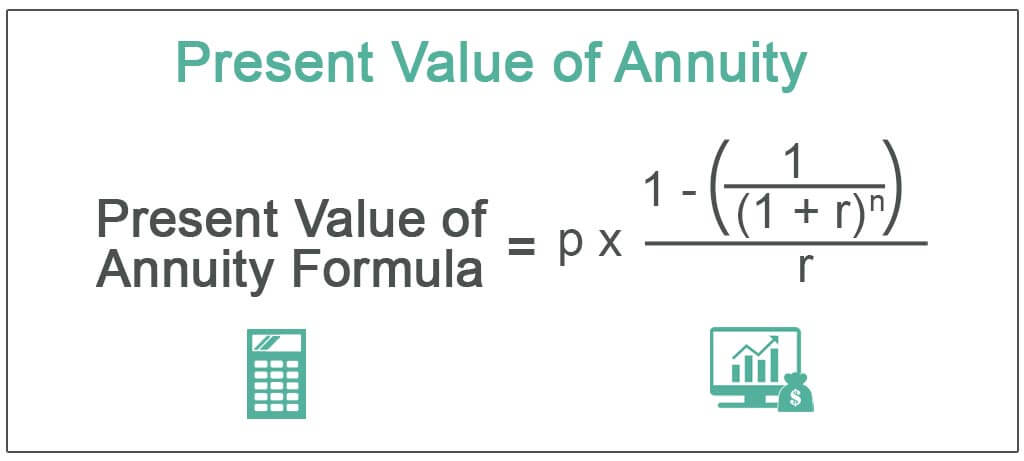

Of periods the interest is compounded. The previous section shows how to calculate the present value of annuity manually. Present value is linear in the amount of payments therefore the.

Studying this formula can help you understand how the present value of annuity works. This is because the payments you are scheduled to receive at a future date are actually worth less than the. Type - 0 payment at end of period regular annuity.

Just by thinking of things intuitively by the time value of money if you have a time series of identical cash flows the cash flow in the first time period will be the most valuable the cash flow in the second time period will be the second most valuable and so forth. Present Value Formula and Calculator The present value formula is PVFV1i n where you divide the future value FV by a factor of 1 i for each period between present and future dates. If you are married you ought to consider joint life expectancy in your calculations.

PVOA APr 1 - 11 rN. Present Value of Growing Annuity PVGA Calculator. Nper - the value from cell C8 25.

It is used to find out the return of future cash flows that will be accrued by the company on todays investment. This future value of annuity calculator estimates the value FV of a series of fixed future annuity payments at a specific interest rate and for a no. Net Present Value can be thought of as a method of calculating Return on Investment on your project.

Present Value of Annuity Due PVAD Calculator. Based on the time value of money the present value of your annuity is not equal to the accumulated value of the contract. The basic annuity formula in Excel for present value is PVRATENPERPMT.

Pmt - the value from cell C6 100000. The more important question perhaps is What rate should I use for the discount ratequot. Future value FV is a measure of how much a series of regular payments will be worth at some point in the future given a specified interest.

Present Value Of An Annuity. By default this value is the same as the Pre-discounted Fair Market Value. Present value of an annuity is finance jargon meaning present value with a cash flow.

To calculate present value for an annuity due use 1 for the type. The future cash flows of. Calculating the Future Value of an Ordinary Annuity.

Present Value of an Annuity PVdfracPMTileft1-dfrac11inright1iT where r R100 n mt where n is the total number of compounding intervals t is the time or number of periods and m is the. Net Present Value Definition. Present Value of Annuity PVA Calculator.

Compound Interest Formula Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. However the table works for discrete values only. The annuity table provides a quick way to find out the present and final values of annuities.

The Net Present Value is difficult to calculate by hand since the formula is very complex. Speak with one of our qualified financial professionals today to discover which of our industry-leading annuity products fits into your long-term financial strategy. The cash flow may be an investment payment or savings cash flow or it may be an income cash flow.

Below you will find a common present value of annuity calculation. You can change this value however if you later change the Pre-discounted Fair Market Value the. The computations are given below.

Find out how an annuity can offer you guaranteed monthly income throughout your retirement. Where is the number of terms and is the per period interest rate. Present Value of Annuity Continuous Compounding PVACC Calculator.

And annuities tend to hold their carrying value better over time. Present Value Of Annuity Calculation. If you choose to invest money as a one-time lump sum payment the future value formula is based on the present value pv rather than periodic payment pmt.

How to calculate present value in Excel - formula examples. Annual interest rate C2. Insert the factor into the.

With an annuity due payments are made at the beginning of the period instead of the end. However in the real world interest rates and time periods are not always discrete. So we set up our sample data as follows.

The program uses this value to calculate the annuity payout the present value of the annuity payments and the present value of the remainder for gift tax purposes. Excel can perform complex calculations and has several formulas for just about any role within finance and banking including unique annuity calculations that use present and future value of annuity formulas. Rate - the value from cell C7 7.

Excel can be an extremely useful tool for these calculations. The present value is given in actuarial notation by. For example to find the present value of a series of three 100 payments made at equal intervals and discounted at 10 you can perform these calculations.

You can find derivations of present value formulas with our present value calculator. Present Value of Annuity Future Value of Annuity and the Annuity Table. The value of bonds.

Present Value Annuity Factor PVAF Calculator. An annuity table or present value table is simply a tool to help you calculate the present value of your annuity. Value from present value of an annuity of 1 in arrears table.

The present value formula applies a discount to your future value amount deducting interest earned to find the present value in todays money. NPV 534855 Explanation. Present Value of Annuity PV is estimated by taking account of the annuity type - If ordinary then the formula is.

According to net present value method Smart Manufacturing Company should purchase the machine because the present value of the cost savings is greater than the present value of the initial cost to purchase and install the machine. Present Value of Pension Options. The present value of an annuity is the value of a stream of payments discounted by the interest rate to account for the fact that payments are being made at various moments in the future.

The discount rate is the rate used to find the present value. If you anticipate a long life expectancy one option may be worth more to you in terms of present value than another option. The present value annuity factor is used for simplifying the process of calculating the present value of an annuity.

Therefore there are certain formulas to.

Present Value Pv Of An Annuity Example Problem Youtube

Present Value Of An Annuity How To Calculate Examples

How To Measure Your Annuity Due

Present Value Of Annuity Formula With Calculator

Present Value Of Annuity Calculation Knime Analytics Platform Knime Community Forum

What Is An Annuity Table And How Do You Use One

Present Value Of An Annuity Formula Wall Street Mojo 2020 Download Scientific Diagram

How To Calculate Present Value Of An Annuity

Present Value Of An Annuity How To Calculate Examples

Ordinary Annuity Calculator Future Value Nerd Counter

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities3-f5e4d156c37b4fffb4f150266cea32b1.png)

Calculating Present And Future Value Of Annuities

Present Value Of An Annuity Definition Interpretation

How To Calculate Present Value Of An Annuity

How To Calculate The Present Value Of An Annuity Youtube

Annuity Formula Present Future Value Ordinary Due Annuities Efm

Present Value Of Annuity Formula Calculate Pv Of An Annuity

Annuity Formula What Is Annuity Formula Examples